Nowadays, the business environment is in the process of changes as it has appeared more progressive technologies that may be implemented into the daily environment. As most business owners would like to make such changes and get only the most necessary tips and tricks, they should be ready to focus on trustworthy information that we have prepared for them. Let’s select the most pivotal technologies for going both incredible lengths.

What can an M&A data room give corporations

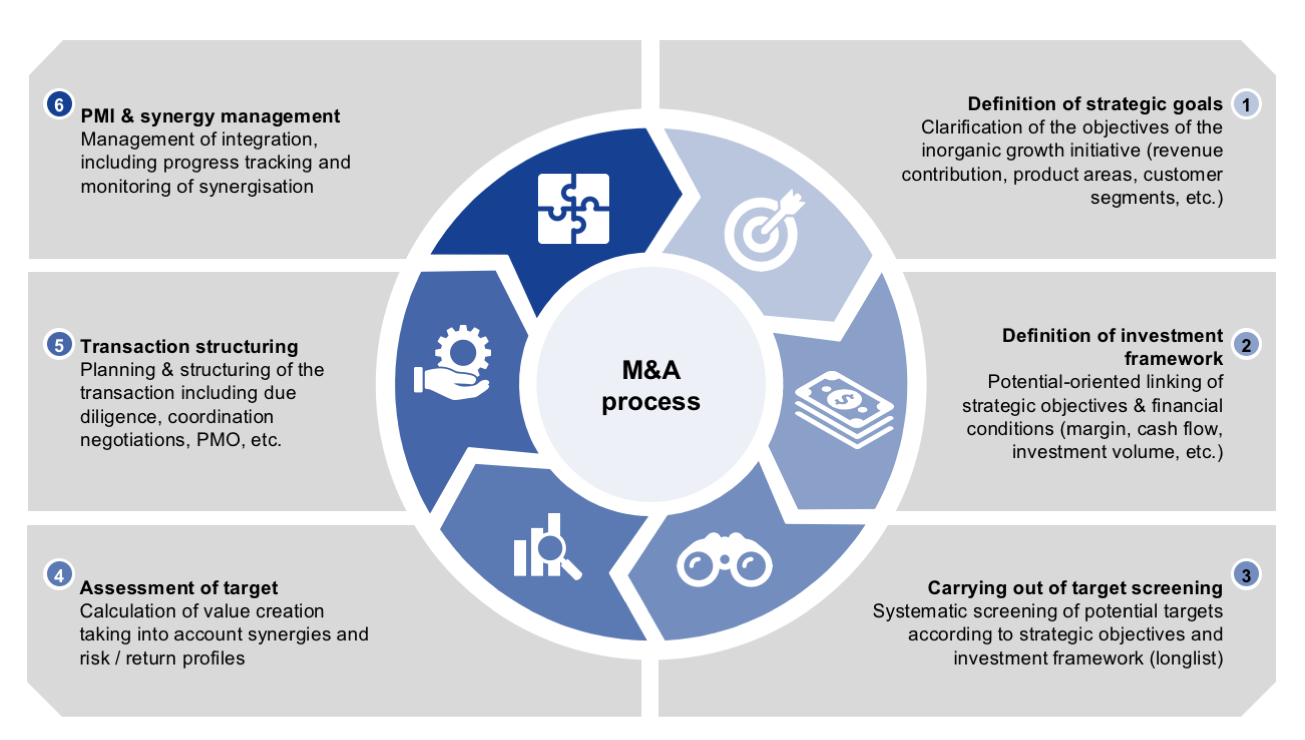

It goes without saying that among different corporations, especially when they work in the same peer. Besides, it is crucial to get more progressive solutions as corporations will get more abilities for fulfilling overall potential. In this way, we propose to pay attention to the M&A data room, which is one of the most reliable tools for producing a wide range of transactions. In particular mergers and acquisitions are the most challenging processes as they demand not only a high level of concentration but enough resources for dealing with a wide range of sensitive data. An M&A data room is a virtual repository where businesses can securely store and share confidential information during the due diligence phase of a merger, acquisition, or any other strategic transaction. These digital spaces have evolved to become central hubs for deal-related documents, ensuring that sensitive information is accessible only to authorized parties. As the outcome, there will be no hesitations whether to store materials or not. Another positive effect of the M&A data room that will be vivid for every user is communication, which is one of the integral parts of productive and healthy business communication, especially between buyers and sellers, streamlining the due diligence process. Annotation and commenting tools allow users to highlight and discuss specific points within documents. For directors, it will be shared another pro as detailed audit trails track user activities, providing transparency and accountability. Reporting features offer insights into document views, downloads, and interactions. That shows that every leader will have everything to be aware of every business moment.

As an M&A dealmaker is crucial for every business that is eager to work on results and have successful business transactions, it is highly recommended to have it in active usage. Furthermore, for professionals, it will be possible to represent investment banks, law firms, or corporate development teams, who are responsible for identifying opportunities, negotiating terms, and guiding clients through the intricacies of M&A deals. M&A dealmaker shares such benefits as:

- effective negotiation expertise to determine the fair value of the target company and find such solutions that are going to practical for both participants;

- oversee the due diligence process, ensuring that all necessary information is gathered and assessed;

- building and maintaining relationships with key stakeholders, including clients, buyers, and sellers, is essential for successful dealmaking, especially with effective communication and negotiation skills;

- structuring the deal, defining the consideration to be paid, and the overall terms of the transaction by balancing the interests of both parties is crucial for a mutually beneficial outcome.

As different organizations have dissimilar projects, it exists something that unites them. We are talking with M&A project management software. Mostly, this software complements the efforts of dealmakers and facilitates the coordination of various tasks, timelines, and teams involved in the transaction. Reliable managers can share special projects with their tasks for those employees, who have enough skills and experience. Employees will have real-time collaboration tools to enhance communication, it will be vivid for managers and directors, and working moments should be simplified communication during critical stages of the deal. With analytics, it will be vivid for managers and directors and working moments should be simplified.

Based on this information and vivid examples, it is highly recommended to make an informed choice. As technology continues to advance, this integrated approach becomes increasingly critical for organizations aiming to maximize value and achieve successful outcomes for every corporation.